Introduction

The Short Strangle strategy is a popular options trading method that seeks to profit from a stable market environment where the volatility and stock price remain relatively constant over the life of the options.

The Short Strangle strategy can generate profits by taking advantage of time decay and low volatility. Traders use the Short Strangle method to sell both call and put options, creating a range where the stock price can fluctuate without significant loss.

Traders who use this strategy aim to benefit from the time decay of the options they’ve sold while limiting potential gains and exposing themselves to significant risk if the market moves sharply in either direction.

The short strangle involves selling both a call and a put option on the same underlying asset, with both options having the same expiration date but different strike prices:

- Call strike price is set higher than the current market price of the underlying asset.

- Put strike price is set lower than the current market price of the underlying asset.

Typically, when this strategy is initiated, both the call and put options are out-of-the-money (OTM).

CLICK BELOW TO ACCESS THE COMPLETE BEGINNER’S GUIDE TO TRADING OPTIONS

Outlook

The trader expects the stock price to remain within the range of the two strike prices (between the call and put strikes) throughout the life of the options. The strategy works well in low-volatility environments where the stock price is not expected to move significantly.

Motivation

The main motivation behind the short strangle is to profit from the premium collected by selling the call and put options. If the stock price stays within the defined range until expiration, both options expire worthless, allowing the trader to keep the entire premium.

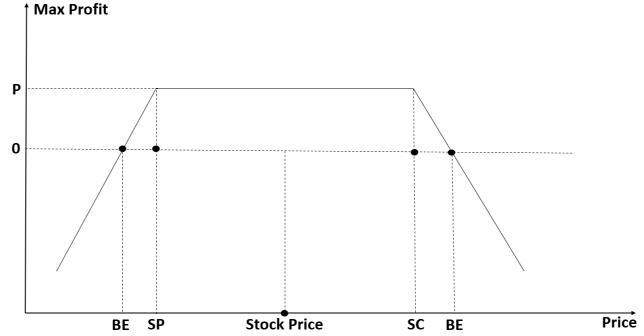

Payoff Diagram:

Mathematical Example:

Example Ticker: ABC

- Short Call: Sell 1 Call at $50 Strike Price

- Short Put: Sell 1 Put at $40 Strike Price

- Premium Collected: $2 from the call + $1.50 from the put = $3.50 total premium

Max Gain:

The maximum gain is limited to the total premium collected when the strategy is initiated.

For this example, the max gain is:

Max Gain = Premium Collected = 3.50 x 100 = $350

Max Loss:

The maximum loss is theoretically unlimited on the upside because the stock price can rise indefinitely. On the downside, the loss can be significant if the stock drops to zero, although this is mitigated by the premium collected.

Max Loss (upside)= ∞ (if the stock price rises substantially)

Max Loss (downside) = (40−0−3.50) × 100 = 36.50 × 100 = $3650(if the stock drops to zero)

Breakeven Points:

To find the breakeven points, you can calculate how far the stock price can move before losses begin.

- Upper Breakeven:

Call Strike + Premium Collected = 50 + 3.50 = $53.50

- Lower Breakeven:

Put Strike − Premium Collected = 40 − 3.50 = $36.50

For this example, the stock must stay between $36.50 and $53.50 for the trader to be profitable.

Profit/Loss Scenarios

- If the stock price stays between $40 and $50 (within the strike prices):

- Both options expire worthless.

- The trader keeps the entire premium of $350.

- If the stock price rises above $53.50:

- The call option will be in-the-money, and the trader will incur losses on the call position. The loss is offset slightly by the premium collected.

- If the stock price falls below $36.50:

- The put option will be in-the-money, and the trader will incur losses on the put position. Again, the premium helps to reduce the total loss.

Payoff Diagram:

Download Below our Two Best Options Strategies

Time Decay (Theta):

Time decay works in favor of the short strangle strategy. As time passes, both the call and put options lose value due to the natural decay of their extrinsic value. If the stock price remains stable, this decay accelerates as expiration approaches, benefiting the seller of the options. The total gain from time decay can be expressed as:

Total Gain from Theta Decay = Initial Premium Collected × Days Passed / Total Days to Expiration

Volatility (Vega):

An increase in implied volatility can be detrimental to the short strangle. Higher volatility increases the value of both the call and the put options, even if the stock price remains stable. This increase in option prices forces the seller to maintain additional margin or close the position at a loss.

A mathematical formula for Vega’s impact: Δ Option Price = Vega × Δ Implied Volatility

Risk of Assignment:

In a short strangle, the risk of early assignment exists, especially for American-style options. Early assignment can occur when the call option becomes in-the-money (especially near ex-dividend dates) or when the put option goes deeply in-the-money. This risk is important to monitor as it may result in the trader having a long or short stock position unexpectedly.

Risk of Expiration:

As the options approach expiration, if the stock price is near either strike, the trader might be assigned and left with an open stock position. For example, if the stock closes just above the put strike or just below the call strike at expiration, the trader may find themselves with a long or short stock position on the following Monday after expiration.

Conclusion

The Short Strangle strategy is a neutral options trading approach that profits from time decay and stability in stock prices. It can be a highly profitable strategy if the stock price stays within the range of the strike prices and volatility remains low. However, the downside risks are significant, especially if there is a sharp movement in the underlying asset’s price.

Key Takeaways:

- Max Gain: Premium collected.

- Max Loss: Unlimited on the upside, significant on the downside.

- Breakeven Points: Calculated based on the call strike + premium and put strike – premium.

- Volatility Impact: Negative impact if volatility increases.

- Time Decay: Positive effect as options lose value over time.

By applying this strategy carefully and managing the risks, traders can benefit from a consistent and well-executed short strangle strategy. However, it’s crucial to monitor volatility and be aware of the risks involved in this approach.