We compare trading Covered Calls to owning a rental property. Just like a landlord earns rent, a trader generates income by selling call options on stocks they own.

The buyer of the call option has the right, but not the obligation, to purchase the stock at an agreed-upon price (the strike price), making this strategy ideal for creating additional income streams.

Tip: Covered calls are most effective when you have a neutral to mildly bullish outlook, so using them in a strong bull market can result in opportunity costs.

Covered Call Trade Entry Guide

When writing Covered Calls on high-quality companies, it’s important to understand moneyness (the relationship between the option’s strike price and the stock’s current price). This is crucial for trade success. The goal is to enhance portfolio income by selling call options, using moneyness to choose the best trade setups.

Key Trade Entry Metrics:

- Delta (∆): 12 to 30, depending on market conditions

- Standard Deviation (STD): 0 to 1.2

- Days to Expiration (DTE): 3 to 6 weeks

- Goal: Collect premiums

- Objective: Either keep the premium or sell the stock if assigned

- Implied Volatility Rank (IVR): The higher, the better

- VIX: The higher, the better

- Liquidity: Only trade liquid stocks for smooth entry and exit

Key Takeways

- A covered call is a common options strategy that allows investors to earn income when they believe stock prices will not significantly increase in the short term.

- This strategy involves holding a stock position while selling call options on the same stock, with the call options matching the size of the long stock position.

- Covered calls can limit the investor’s potential profit if the stock rises significantly and offer limited protection against a decline in stock price.

- If the buyer of the call option exercises their right, the seller will sell the shares at the strike price and keep the premium from selling the option.

Covered Call Outcomes at Expiration

There are two possible outcomes when the option expires:

- Stock Price at or Below Strike Price: The trade expires Out-of-the-Money (OTM), and no assignment occurs. You keep the premium, and you can write another Covered Call to continue generating income.

- Stock Price Above the Strike Price: The trade expires In-the-Money (ITM), and the stock is sold at the strike price. You can then start the Covered Call “wheel” by selling another call on newly assigned shares, continuing the cycle of income generation.

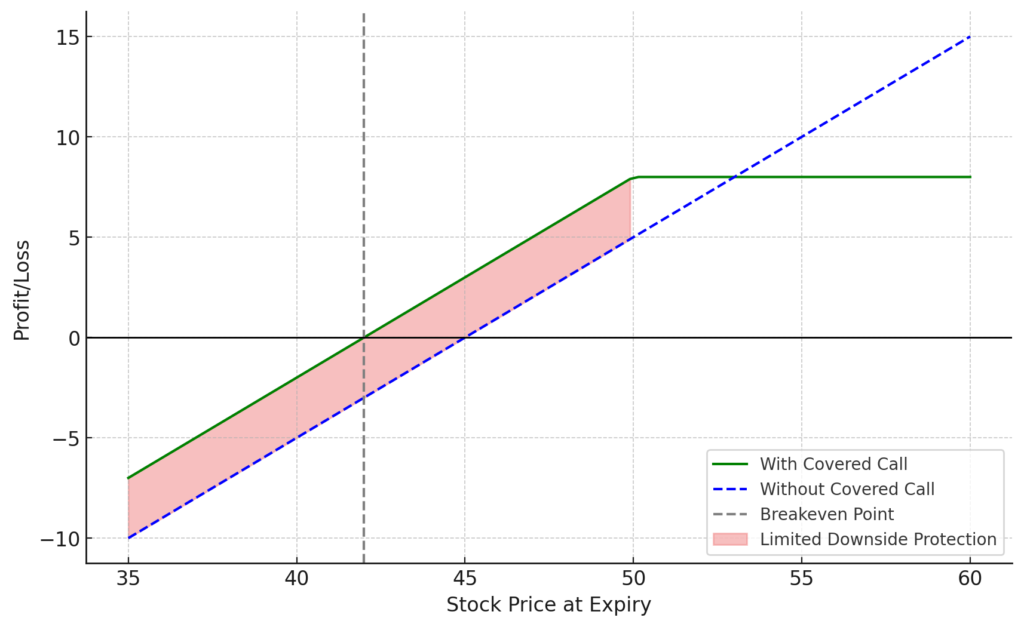

Example of Covered Call in Action

Let’s assume you purchase ABC stock at $45 per share.

Anticipating that it will rise to $55 within a year. However, you’re willing to sell at $50 within six months, taking a short-term profit while capping further upside. In this case, selling a covered call might be an ideal strategy.

According to the option chain, selling a $50 six-month call option would earn you a $3 per share premium. You could sell that option against your shares bought at $45, with the intention of selling at $55 in a year.

Writing this covered call obligates you to sell the shares at $50 within six months if the stock reaches that price. You keep the $3 premium, plus the $50 from selling the shares, for a total of $53 per share, resulting in a 17.78% return over six months.

If the stock drops to $35, you would face a $10 loss on your original position. However, the option buyer won’t exercise the contract since they can buy the stock cheaper than the strike price. Still, you retain the $3 premium from selling the call, reducing your total loss from $10 to $7 per share.

Bullish Scenario: Shares Rise to $55, and the Option Is Exercised

- January 1: Buy ABC shares at $45

- January 1: Sell ABC call option for $3, exercisable at $50, expiring on June 30

- June 30: Stock closes at $55—option is exercised since the stock price is above the strike price, and you receive $50 for your shares

- July 1: Profit: $5 capital gain + $3 premium = $8 per share, or 17.78% return

Bearish Scenario: Shares Drop to $35, and the Option Is Not Exercised

- January 1: Buy ABC shares at $45

- January 1: Sell ABC call option for $3, exercisable at $50, expiring on June 30

- June 30: Stock closes at $35—the option expires worthless since the stock is below the strike price

- July 1: Loss: $10 share loss – $3 premium collected = $7 total loss, or -15.56%

This example demonstrates how covered calls can generate extra income through premiums while managing potential losses.

Advantages and Disadvantages of Covered Call Strategy

What we like

What we don’t like

Managing Risk: Systematic and Unsystematic Risks

High-quality companies can still face systematic risk, which is risk affecting the entire market. Trading, we focus on managing this risk before the trade is placed, as it’s the only point where we have full control. By carefully controlling position size and trade entry, we ensure that the Covered Call strategy works even in challenging market conditions.

Final Thoughts

Trading, our priority is maximizing gains and minimizing losses. Covered Calls allow us to earn consistent income while keeping risks under control. By managing trades effectively, even in volatile markets, we continue to profit while maintaining long-term portfolio stability.